Bonds Trading

WHAT IS BONDS TRADING?

Bond trading is the buying and selling of debt securities, which are issued by corporations, governments, or other organizations. When you buy a bond, you're essentially lending money to the issuer in exchange for a fixed interest payment over a specific period of time. The bond issuer promises to repay the principal (the initial investment amount) to the bondholder when the bond reaches maturity.

Bond CFDs enable you to trade on the price movements of bonds, allowing you to potentially profit from both rising and falling bond prices. This can be particularly advantageous in volatile or changing interest rate environments. Like other CFDs, bond CFDs allow you to trade with leverage, meaning you can control a larger position with a smaller amount of capital.

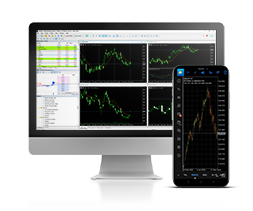

You can choose between the MT4 and MT5 platforms and the Tandem App to start trading CFDs on Bonds.