Indices Trading

WHAT IS INDICES TRADING?

Indices trading refers to buying and selling financial instruments that track the performance of a group of stocks or other financial assets, rather than individual securities.

An index is essentially a measurement of the performance of a particular market, and indices trading involves trading on the direction of that market by buying or selling derivatives based on the index.

For example, the S&P 500 index tracks the performance of the top 500 publicly traded companies in the United States.

By trading S&P 500 futures contracts, traders can trade on whether they believe the overall value of those companies will go up or down.

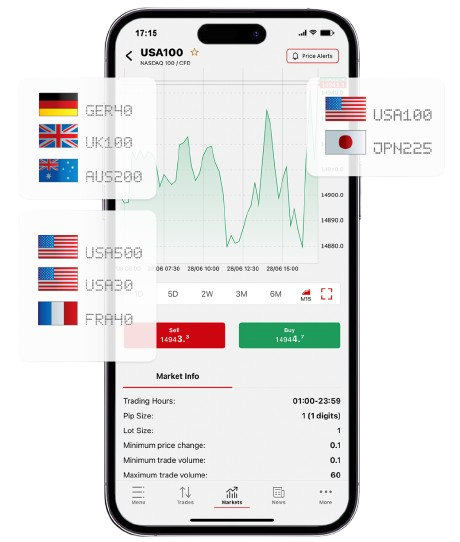

Indices trading can be done through a variety of financial instruments, including contracts for difference (CFDs) which allows for leveraged trading. At Tandem, you can trade CFDs on major Indices, such as UK 100 and GER 40, with leverage and ultra-fast execution.

Indices trading can be done through a variety of financial instruments, including contracts for difference (CFDs) which allows for leveraged trading. At Tandem, you can trade CFDs on major Indices, such as UK 100 and GER 40, with leverage and ultra-fast execution.